Taxes are an essential aspect of every working individual’s life, yet they often remain a source of confusion and frustration. Understanding how taxes work, especially the deductions taken from your paycheck, is crucial for financial planning and managing your budget effectively. In the United States, paycheck deductions encompass various taxes, including federal income tax, Social Security tax, and Medicare tax. This article aims to shed light on these deductions, providing clarity on how much is deducted from your paycheck and where it goes.

Federal Income Tax: Understanding the Basics

Federal income tax is a primary component of paycheck deductions in the US. It is a progressive tax, meaning the more you earn, the higher percentage of your income goes towards taxes. The amount deducted depends on your income level and tax bracket, which is determined by the IRS. Tax brackets range from 10% to 37%, with higher-income earners paying a larger percentage of their income in taxes. Your employer calculates federal income tax withholding based on the information you provide on Form W-4, including your filing status and the number of allowances claimed.

Social Security Tax: Securing Your Future

Social Security tax is another deduction taken from your paycheck, aimed at funding the Social Security program, which provides retirement, disability, and survivor benefits to eligible individuals. As of 2024, the Social Security tax rate is set at 6.2% for both employees and employers, up to a certain income threshold. For 2024, the maximum taxable earnings subject to Social Security tax is $147,000. Once you reach this threshold, you no longer pay Social Security tax on additional income for that year. In the future, when you deal with disability benefits then all this would have already increased your chances of winning disability benefits.

Medicare Tax: Investing in Healthcare

Medicare tax is deducted from your paycheck to fund the Medicare program, which provides health insurance to people aged 65 and older, as well as certain younger individuals with disabilities.

Unlike Social Security tax, there is no income threshold for Medicare tax, meaning all earned income is subject to this tax. As of 2024, the Medicare tax rate is 1.45% for both employees and employers, with an additional 0.9% Medicare surtax for high-income earners (those with wages exceeding $200,000 for individuals or $250,000 for married couples filing jointly).

The Broader Impact of Tax Policies

Beyond paycheck deductions, tax policies influence both individual and business finances. For example, economic nexus thresholds require businesses to collect sales tax across different states, impacting costs and availability for consumers. These policies shape job growth, wage levels, and operational costs, affecting everyone indirectly. Understanding these broader impacts can provide insight into how taxes shape financial decisions at all levels.

Additional Deductions: State and Local Taxes, Retirement Contributions, and Benefits

In addition to federal income tax, Social Security tax, and Medicare tax, your paycheck may also be subject to other deductions, such as state and local taxes, retirement contributions (e.g., 401(k) contributions), and various employee benefits (e.g., health insurance premiums). The specific deductions vary depending on your location, employer policies, and individual preferences. It’s essential to evaluate your paycheck stub regularly to understand all deductions and ensure accuracy.

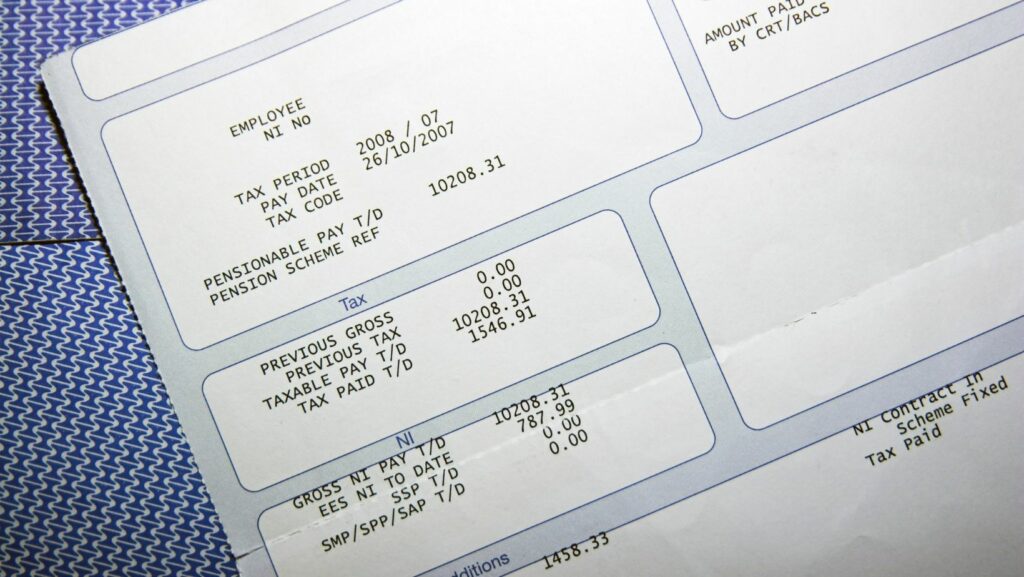

Understanding Your Pay Stub: Decoding the Numbers

Your pay stub provides a detailed breakdown of your earnings and deductions for each pay period, helping you understand how much is deducted from your paycheck and where it goes. Key information on your pay stub includes gross pay (total earnings before deductions), net pay (take-home pay after deductions), and itemized deductions for taxes, benefits, and other withholdings. Evaluating your pay stub regularly can help you identify any discrepancies or errors in your paycheck deductions and take appropriate action to address them.

Leveraging Paycheck Calculators for Financial Planning

To understand how much taxes deducted from paycheck calculator is an invaluable tool for individuals seeking to estimate their take-home pay and understand how much taxes are deducted from their paycheck. These online resources allow you to input various factors, including your salary, filing status, allowances, and deductions, to generate an accurate projection of your net pay.

By utilizing a paycheck calculator, you can gain insight into how different scenarios, such as adjusting your withholdings or contributing more to retirement accounts, impact your paycheck and tax liability. Moreover, paycheck calculators provide a level of transparency, enabling you to see precisely how much of your earnings go towards taxes and other deductions. This knowledge empowers you to make informed financial decisions and optimize your budget accordingly.

Conclusion

Understanding paycheck deductions is essential for financial literacy and effective budget management. By grasping the basics of federal income tax, Social Security tax, Medicare tax, and other deductions, you can make informed decisions about your finances and plan for your future with confidence. Take the time to evaluate your pay stub, consult with financial professionals if needed, and stay informed about changes in tax laws and regulations to ensure you’re maximizing your earnings and minimizing your tax burden.